Amazon’s demand-side platforms (DSPs) may not be the first platforms that come to mind when putting together a portfolio of channels that include display options.

The first thing that comes to mind is the Google Display Advertising Network (GDN) – possibly Trade Desk, Criteo, or any number of exchanges – probably assuming that you have to be a seller on Amazon to take advantage of a DSP.

It doesn’t.

In fact, it’s a great way to take advantage of a network of Amazon-owned sites like IMDB and its connected partner exchanges, just like Google does.

And yes, these are the sites where you direct ads back to you, not Amazon.

Additionally, you can leverage Amazon’s deep knowledge of consumer behaviour on its network and platforms, for example:

- Purchase history.

- Brand affinity.

- Executed searches.

The 184 million monthly U.S. visitors are also a benefit.

Let’s break it down, starting with the options that are most appealing to search marketers conducting displays, and then move on to some options for more visible media buys based on classic demand capture and retargeting.

What you need.

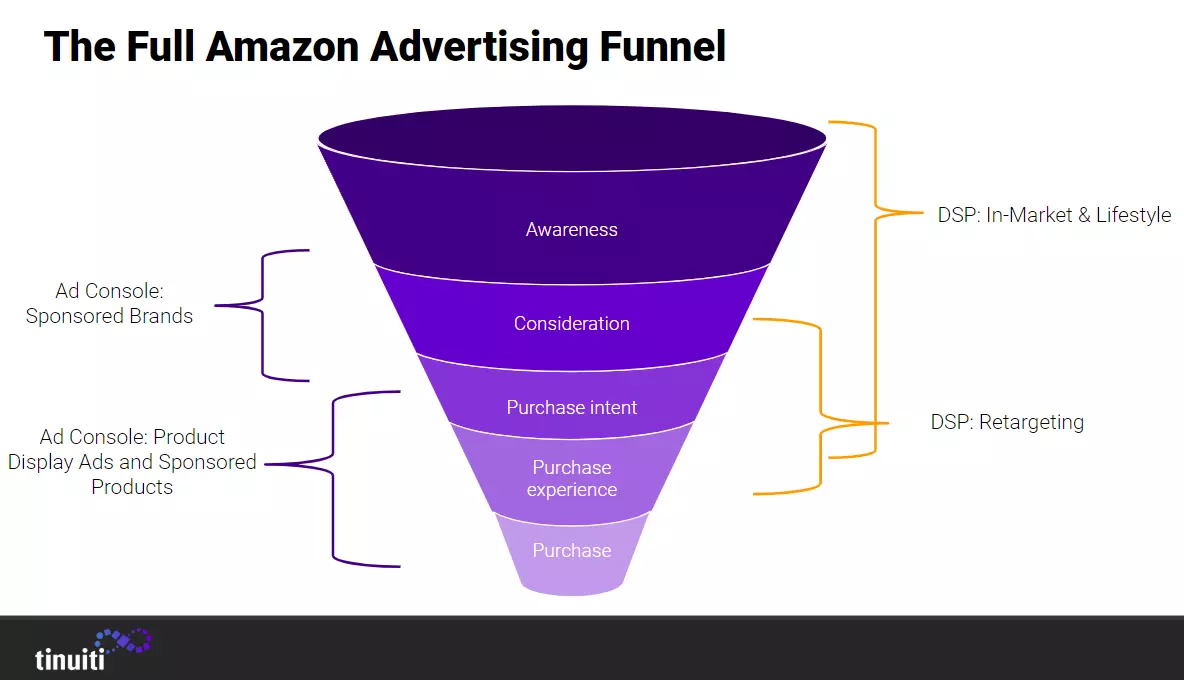

First, you’ll need a DSP account that’s separate from the Amazon Ads Console account you use to run Amazon advertising options like Sponsored Products, Sponsored Brands, and Product Display Ads. The Amazon Advertising Console account is separate.

Just like in a GDN and any programmatic campaign, you’ll also need to create assets such as banners, inserts, and short videos to Amazon’s specifications – depending on what you want to do.

There’s no automated creator or template like Google Display Builder.

But similar to Google, it can take a while to build impressions and get performance data, so you’ll need to plan for a similar length of launch date and be equipped with sufficient asset inventory.

Ad Display Locations

In addition to well-known sites like IMDB, Audible, and others that Amazon acquired this week, you can view a list of exchanges here.

This list also includes third-party partners you can use to upload first-party data, such as email unsubscribe information. (Don’t make it easy for them to get away with it!)

Note: For those familiar with the space, you may see some exchanges you recognise.

There may be overlap if you are advertising on both platforms at the same time, and perhaps even displaying two ad units in the same space. For example, The Trade Desk does have advertising resources for Amazon Fire TV, but not for first-party audiences or Amazon e-commerce attribution.

Examples of Dynamic CTA Amazon DSP Units

Some more specific notes on creativity – you need to not only provide assets, you need to pay attention:

- A call to action.

- The use of text in the creative.

This is because there is a dynamic ad unit where the call to action is covered by Amazon.

You can’t select a CTA or get statistics on which CTA was used, when it was used, or detailed performance, only the overall performance of the creative size and version.

So if you’re going to re-use Google or Facebook assets, make sure you adjust them appropriately.

From a search marketer’s perspective, my most recommended starter unit is the Dynamic Ads unit for Market Audiences.

It’s most similar to the dynamic option on Google, and you can leverage Amazon’s knowledge of each user’s response/CTA. While this is technically a middle-of-the-funnel strategy, it’s more likely to get into buying range.

Marketplace audiences will be targeted to those who have recently (in the last 30 days) searched for or purchased a product in your category and have access to very specific information through Amazon’s network.

I saw a Tom Hanks fan clip and now that I think about it, don’t we all love it? Maybe a clip of Paul Rudd, a less popular but equally kind man, should have been chosen?

As a real life example, if you wanted to launch a new range of kitchen utensils (including spatulas and blenders for all!) ), then you could target the market audience for mixers, ovens or kitchen utensils.

Whilst it’s best to start with something broader (kitchen utensils) and then narrow it down, I know your inner search marketer may not like to ‘pay’ for these learnings and want to be more specific at the start.

Therefore, stratifying or blocking certain sites/exchanges for certain household income and age ranges prior to launch would be the best way to achieve this without having to lower your bids too much.

However, depending on your budget and desired reach, you may want to start with a broader network, such as audience segments in Google. Then, layer in demographic targeting (or category exclusion) and then narrow it down for efficiency.

Here’s how DSP compares to other Amazon advertising products in the buying channel.

Costs and time required

Costs are based on CPM. Campaigns can take a little time to collect enough displays and the data needs to be smart enough to target properly and accelerate.

Amazon recommends an ‘always-on’ approach (sound familiar again?). which makes sense for ongoing advertisers with retargeting plans.

Over time, the platform will become more efficient and you’ll be able to build better groups of similar audiences to add as segments later. (Remember, Amazon has a lot of purchase data!)

The real answer: you’ll need to get it set up and running for at least 3-6 weeks before making any major tweaks, depending on the volume you’re seeing.

In terms of average CPM, expect to pay between $4 and $6 depending on the category, with larger catalogues (thousands of products) requiring larger budgets.

The number of available displays per month for most market segments is around 500 million, again, depending on the segment.

The recommended budget to start this work is around $5,000 per month, especially if you want to retarget smaller catalogues (tens of products).

Ideally, closer to $10,000 per month to be able to run it with real flexibility, because just like any other programmatic trade, the targeting options can be quite unlimited.

Going Further: Repositioning

There is a retargeting option, but it requires the Amazon pixel to be installed on key pages (ideally the checkout page, home page, and receipt page) in order to build an audience.

But recognising that some e-commerce sites choose not to sell on Amazon, they may be reluctant to provide this information to Amazon, so this is an option that won’t work.

However, if you’re advertising and the main reason you don’t sell on Amazon is more due to logistical difficulties in meeting fulfilment, inventory, review and pricing requirements, then this is a great solution to engage the 148 million monthly users of a platform that is said to account for 48% of all e-commerce transactions.

(On Choices, Strategies and Requirements is a whole other post in itself, and I have a schedule to keep, so check back later in the year. I just want you to skim through this post today).

Spreading the word: Networked TV and lifestyle audiences

For those who are purely looking for awareness/brand recognition, consider Amazon’s OTT (over the top) unskippable videos on Fire TV and Fire Stick. These videos can be 15, 20 and 30 seconds in length.

With more than 7 billion hours of streaming on the platform in the fourth quarter of 2018 (according to Amazon ads), it’s a well-known fact that many people watch TV (linear or connected) with another device in hand – about 45% of American adults admit to doing so.

However, this medium does require offline measurement capabilities or modelling if you want to understand the full effect of the effort.

You could also opt for the very simple option of running this campaign on Amazon only, and see if there’s any lift from other channels on the fly. (This is not the most scientific approach, but I’ve heard that the Earth is now flat, so anything is possible.)

There is another option in the cognitive bucket, Lifestyle Audiences, where you can target users based on broader interests such as ‘foodies’ and ‘sci-fi fans’.

This option follows the same creative specifications and CPM fees as in-market, but is definitely more of a programmatic media buy in terms of views, returns and measurement metrics.

I would recommend this ad unit to run after In-market for those who want to do a larger trial run.

Ideally, you can run both in-market segmentation and lifestyle segmentation, fill up the retargeting pool, launch it, and then rinse and repeat with more product as you’re able to build creative assets.

Summarising

Inventory changes as customers, locations and needs change.

Amazon Advertising continues to be a new source of possibilities and has a lot of room to run and a lot of data to work with.

I’ve barely dug into the real offerings available here, and I recommend checking out the Amazon Ads website and using traditional Google search for DSP content and recommendations.