We all know it’s no secret.

Amazon has turned budgets upside down, raised conversion expectations, and called attention to the quality of the content being ‘clicked’ on. (Lots of first-party data is a great thing, isn’t it?)

So rather than revisit the scale of impact known to date, let’s look back a few levels and take a larger view of the problem:

- What it means.

- Who’s at the party.

- What you should be thinking about as we move into 2024.

Amazon isn’t the first or only marketplace to advertise – it’s just a sign of what’s to come, the inevitable cyclical expansion of advertising.

What we need to do is stop working in silos and bring our overall digital technologies together. (I’d like to add other technologies, like offline and local, but one thing at a time, right?)

One thing I’d like to point out before I start with the examples is a fundamental difference I hear a lot of searchers complain about when comparing marketplace ad platforms to search options.

Keep in mind that advertising is the second largest source of revenue (and sometimes the third or fourth largest source of revenue) after marketplace sales when it comes to generating revenue.

The revenue a marketplace generates from advertising costs is only a small fraction of the revenue it generates from seller fees (category commission rates, ranging from 5%-20% of sales, sometimes as high as 40%) and shop fees (monthly fees).

Comparatively speaking, increased ad revenue is a small amount.

They just want you to spend a little more.

So as you consider your investment in platforms, reporting features and attribution, search engines are highly motivated to answer these questions and often provide these tools for free to keep you searching on the platform rather than in the marketplace.

Okay, end of spiel.

Advertising in the Marketplace

Example – Let’s look at a non-exhaustive list of marketplaces that currently offer self-serve advertising:

- Amazon

- Walmart

- Werfel

- eBay

- Houzz

- Etsy

Invite only marketplace/retailer advertising options:

- Target (via Roundel) (select sellers)

- Costco

- Backlog

- Kroger (via 8451)

Before socialising with Facebook/Instagram, Pinterest (e-commerce friendly), this list is much longer than the list of the two giants, Google and Microsoft.

Granted, Amazon and Walmart top the list in terms of volume, and both companies are investing heavily in advertising options to expand their businesses.

But what intrigues me is the natural desire to diversify budgets, and now we either have to find more budgets or steal them from elsewhere.

The return of traditional advertising

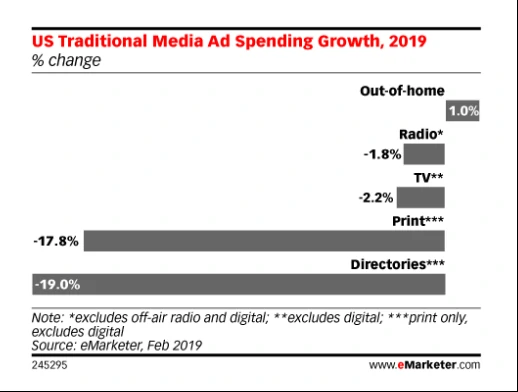

According to eMarketer’s current forecast (February 2019), traditional ad spend will decline slightly and digital ad spend will overtake traditional ad spend for the first time this year.

That said, there are some new players in the traditional space that we haven’t seen before – specifically, startups and D2C brands that are looking for places and spaces to raise awareness but are being pushed out of digital channels due to price or saturation.

Roman’s Rob Schultz told Digiday:

‘With new business, you try to scale up, but at some point the cost of lead generation for Facebook is going to exceed your budget. It’s a trend now – companies are trying to figure out how to fill channels and get people into retargeted channels. TV in particular – you’ll see a lot of brands on the direct response side investing more money there because it’s an effective channel. It’s being treated like a digital channel.’

So …… cutting your traditional advertising budget may not be a good idea. In fact, you might want to spend more.

Get a head start on the rise of marketplace advertising

I can’t tell you exactly what to do, or where to get the money from; that’s not how things work.

I can only tell you what happens next:

- More advertising options in the marketplace.

- More silos need to be broken down.

But from an organisational perspective, here are a few things you can do that will prepare you to successfully navigate this expanding digital world.

1. retail readiness

This means being able to:

- Compete in an automated way on pricing, multiple fulfilment centres (or staffing one fulfilment centre appropriately) stock intelligence (inventory, quantity and reduction).

- Handle returns, customer complaints, comments and process orders. The new standard is two days.

Searchers aren’t usually involved here – I get it, we sell this stuff. But you need to start understanding this stuff too.

If your .com conversion rate starts to slowly decline over time and you’re not keeping an eye on where else the item is being sold …… then you could be losing sales to Amazon.

If the .com lists a 7 day shipping period and your brand has FBA (Amazon Logistics) set up for that product and it offers 2 day free Prime shipping at a lower price, guess what your conversion rate is? (Also, if this is the case, you may want to check out the Amazon Attribution Beta.)

2. Content and Creativity

Take advantage of the features and functionality each platform offers – they’re built that way for a reason.

Some reasons are better than others, but there are key differences in their functionality (e.g., Amazon product page vs. Walmart product page.)

Additionally, if the product content is informative, useful, customer friendly, consistent, and aesthetically pleasing, it will lead to conversions.

Product pages are crawled, indexed and fully displayed in search results. Full control of SERPs.

3. Internal organisation

This is the first ‘thing’ I’ve seen that causes e-commerce development to break down or get in the way.

If the people in an organisation are not motivated to push the envelope in the digital space, then they won’t do it.

If there’s no incentive, at least have a dialogue to clarify roles and responsibilities and how they relate to each other.

4. Process

Riding on the coattails of the internal organisational part of the business, without a clear process for which platforms to launch products on, pricing and fulfilment, things can quickly become very confusing.

5. Products

Invest in the tools of the trade for growth. Or build it. Casually.

(Or burn proprietary tools/systems that have been around since 2010 and require a developer to maintain who is always busy and therefore putting the business at risk. Unfortunately, this is a true story and has happened more than once.)

Asking for more

Every year, search marketers are asked to do more – ad types, targeting, new platforms, new markets – and often with the same tools and resources as the year before.

In 2020, start asking for more in return to help you navigate and succeed in the ever-expanding digital advertising landscape.

For example – point-of-sale data.

If you work for a brand or for a brand with a brick and mortar shop, what useful information are they doing, getting, or have access to?

Some offline attribution would be great, but how about bidding based on location, category or product level?

Think about what’s popular online: is it because they can’t buy it where they live? Do people who live nearby prefer to buy in a brick-and-mortar shop elsewhere rather than online?

Visualisation – Sure, you’re cool and have a spreadsheet with 20 tabs, 17 formulas, slicers and pivot tables that you’ve developed over the last two years.

It’s a nerd’s masterpiece – but let’s face it, it’s the Matrix and you’re Neo. Not everyone can dodge bullets.

Equip yourself with software to make your life easier and gain insights faster. That way, when the bullets start flying, you don’t even have to dodge them.

But most importantly, plan for expansion. Expansion is happening. Get ahead of it now and own it, not be owned by it.